Sponsored Projects Cost Principles

Policy Statement

The University of Illinois System has a responsibility to ensure proper treatment of select items of costs incurred on sponsored projects and for purposes of the Facilities and Administrative Rate Proposal in compliance with federal regulations (Federal Uniform Guidance Title 2 CFR Part 200; formerly OMB Circular A-21), sponsor policy, award terms and conditions, and system policy.

For a cost to be allowable as either a direct charge to a sponsored agreement or as part of an indirect cost pool, it must be: (also see OMB Uniform Guidance Sections 200.403 - 200.405)

- Necessary and reasonable.

- Allocable - A cost is allocable to a project if goods or services involved are chargeable or assignable in accordance with the relative benefits received by the projects.

- Accorded consistent treatment appropriate to the circumstances.

- Conform to any limitations or exclusions set forth in Federal guidance.

- Be adequately documented.

For certain items of costs to be allowable as direct charges, prior written approval from the sponsor may be required.

There is no universal rule for classifying certain costs as either direct or indirect (F&A). A cost may be direct with respect to some specific service or function, but indirect with respect to a sponsored award or other final cost objective. Therefore, it is essential that each item of cost incurred for the same purpose be treated consistently in like circumstances either as a direct or an indirect (F&A) cost in order to avoid possible double-charging of sponsored awards.

Determining allowability of costs is the primary responsibility of the principal investigator (PI). While PIs may designate departmental administrative staff to assist, the ultimate responsibility for the oversight and management of the sponsored project remains with the PI.

Inherent in this responsibility is the PI's obligation to adhere to all terms and conditions of the award, and to ensure that costs charged to the project are allowable and directly benefit the project charged.

For questions related to your award's requirements, please seek guidance from your university Office of Grants & Contracts.

Reason for the Policy

This policy is designed to provide guidance for the treatment of select items of costs to ensure the system complies with the requirements of Office of Management and Budget (OMB) Circular A-21 for awards issued prior to December 26, 2014 and the Uniform Guidance 2 CFR Part 200 for awards issued thereafter, awarding agency regulations, and the terms and conditions of the underlying award. According to Public Act 098-0706 - Grant Accountability and Transparency Act, the State of Illinois has adopted the Uniform Guidance.

Applicability of the Policy

To maintain consistency in the treatment of select items of costs, this policy applies to all sponsored projects. In the event that sponsor policy or specific award terms and conditions prescribe otherwise, such policy or terms and conditions shall prevail. In addition, this policy addresses treatment of costs on non-sponsored funds which flow into the Facilities & Administrative Rate proposal.

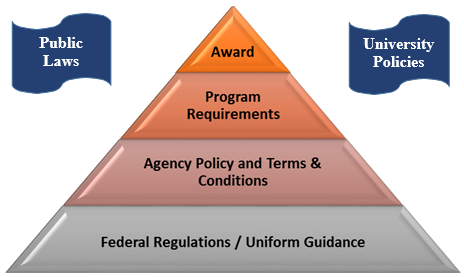

Order of Precedence to Determine Allowability

Sponsors may restrict allowability of costs in several ways:

- In the terms and conditions of an individual award.

- In the terms and conditions of an individual funding program.

- In agency grant guidelines, including federal research terms and conditions and agency-specific terms and conditions.

- Uniform Guidance

In addition, costs must abide by Public Laws and the system Policies.

In case of a discrepancy between the provisions of a specific award and this policy, the award shall govern.

Responsibility for Compliance

According to Uniform Guidance 2 CFR Part 200 Subpart E - Cost Principles and OMB Circular A-21 Section C.4.d (1) Cost Principles for Educational Institutions, the recipient institution is responsible for ensuring that costs charged to a sponsored project are allowable, allocable, and reasonable under these cost principles. This establishes the system's responsibility for compliance with these and other cost regulations.

Principal Investigators (PIs) and their departments are responsible for complying with the applicable sponsor requirements for sponsored projects and for the prudent management of all expenditures and actions affecting the award. Documentation for each expenditure or action affecting an award must reflect appropriate organizational reviews or approvals which should be made in advance of the action. Organizational reviews are intended to help assure that expenditures are allowable, necessary and reasonable for the conduct of the project, and that the proposed action

- is consistent with award terms and conditions;

- is consistent with sponsor and the system policies;

- represents effective utilization of resources; and

- does not constitute a significant project change.

PIs and their departments are responsible for assuring that costs assigned to federal projects are compliant with sponsor requirements. Restricted cost categories and other inappropriate charges can be readily detected in audits, and resulting disallowances must be reimbursed to the federal government. In most cases, this will be the financial responsibility of the department. Final technical reports, where required, are the responsibility of the PI. Payments withheld because of delinquent technical reports become the responsibility of the department.

Treatment of Select Items of Cost

The Treatment of Selected Items of Cost page outlines treatment of commonly used costs based on Federal guidelines and regulations and the system policy.

The list is not meant to be all inclusive. Failure to mention a particular item of cost is not intended to imply that it is either allowable or unallowable.

Treatment of Selected Items of Cost

Code Unallowable Costs

Frequently Asked Questions

OMB Uniform Guidance Sections 200.403 - 200.405

Last Updated: January 3, 2019 | Approved: Senior Associate Vice President for Business and Finance | Effective: June 2016