Base

Goods or Services Sold (Base)

Service center managers must track actual usage in order to determine compliant service rates. All users or usage base (internal and external) must be included in the base whether charged or not.

- This is in accordance with University of Illinois System policy and Federal guidance, which states that costs of services must be charged based on actual usage of the services and does not discriminate between activities (e.g. sponsored project or other users).

Service center managers must ensure there is no cross-subsidization between user groups. Combining the results of various services is not acceptable when the mix of users of each service is different. The center must use the measurement which considers the cost/benefit of the product or service being provided, in other words, use the measurement which allocates costs equitably among all customers or usage base.

- This is in accordance with University of Illinois System policy and Federal guidance which states when charging costs to a cost objective (e.g. sponsored project or departmental funds) costs must be charged based on the “relative benefits received”. In other words, service rates must be charged based on actual usage.

Detailed supporting base documentation must be maintained on-file by the department and made available for review upon request by system administrators, as well as U of I System, State, and Federal auditors.

A service center may have different measurable units/bases for the different types and classes of products or services it offers. For example, a center that performs tests on samples has a couple of possible units of measure; it could charge per test or per hour. If certain tests take twice as long as others, and labor is a large portion of the cost of performing a test, it is not equitable to charge each user on a per test basis. In such circumstances, the user rate should be charged on a per hour basis.

In addition, the service center needs to consider the types of rates they need to implement when determining proper base for rate calculations (e.g. training rate, staff assist hourly rate, sample rate, etc.).

The base utilized in the rate calculation should represent billable units in order for the line of service to recover all its costs and break-even over time. When compiling the base and depending upon the unit of measure there are certain items to take into consideration.

Below are examples of base calculations and items to consider when deriving billable units:

- Staff Assist Hourly Rate:

- Self-Use Machine Hourly Rates:

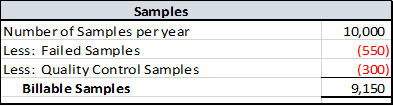

- Samples:

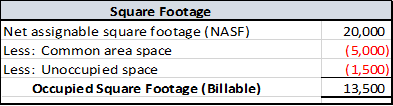

- Square Footage:

- Additional items for consideration:

- Failure rate

- No shows

- Research and development

- Training

Last Updated: July 24, 2018